I frequently hear entrepreneurs refer to Bookkeepers, Controllers, and CFOs interchangeably. The truth is all three positions have significantly different roles and responsibilities. It is important to engage a person with the right skill set to achieve your objectives otherwise you will either end up disappointed with the final product or paying more than necessary for what you need.

When you first start your company, your startup accounting needs focus primarily on compliance, i.e. making sure transactions get recorded properly in your accounting system, filing your HST return on time, making sure your payroll and remittances are processed, and getting things ready to hand off to your external tax accountant to tackle your year-end taxes. This is the realm of the Bookkeeper.

As your company evolves and grows from the startup phase, your accounting needs will change and get more complex i.e. moving from cash based accounting to accrual accounting, needing financial statements that are prepared in accordance with GAAP, working with banks to get operating loans, creating financial models and investor presentations to raise money from venture capital investors. That is where a Controller and CFO come into play.

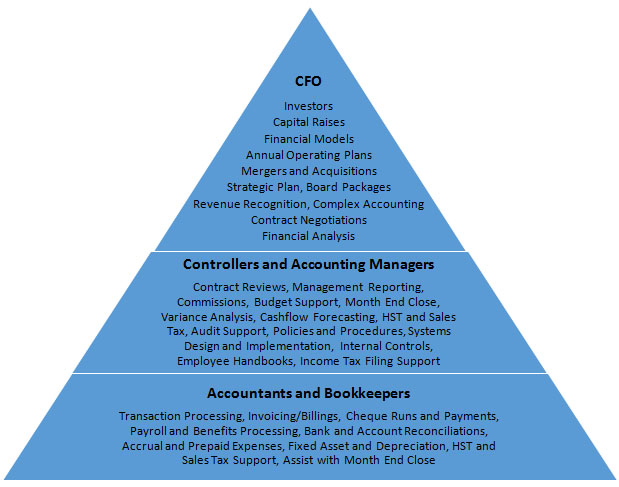

The following graphic illustrates some of the responsibilities of the Bookkeeper, Controller and CFO.

Summary: If you decide to outsource your startup accounting or bookkeeping, working with a firm that has the ability to grow along with you and offer strategic financial advice at the Controller or CFO level is a good way to go. Not only will you get your compliance stuff taken care of but you will have access to a strategic sounding board to help you with the really valuable and hard stuff.