Bookings, billings, and revenue. They all sound like they mean the same thing — money coming into your company from customers. Although all three metrics are driven by the sales your company generates, they provide different insights about the health of your business and should be analyzed separately.

In this article, we’ll explore what each metric means and why they are important for your startup.

Example Transaction

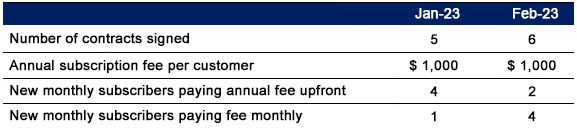

It is useful to have a sample transaction when trying to understand the difference between the three metrics. Below is the example we’ll utilize to highlight the differences between bookings, billings, and revenue.

Company ‘A’ sells a software product with an annual subscription plan. The price for an annual subscription is $1,000/year. Customers have the option to pay their subscription fee annually upfront or monthly throughout the subscription term. For the purpose of this example, we will ignore pro-rated fees and discounts. We will also assume that customers are invoiced in the same month that they become a subscriber.

In January 2023, Company ‘A’ signs up 5 new subscribers. 4 of the customers paid their subscription fee annually upfront, while 1 customer chose to pay monthly.

In February 2023, Company ‘A’ signs up 6 new subscribers. 2 of the customers paid their subscription fee annually upfront, while 4 customers chose to pay monthly.

What Are Bookings?

Bookings are the total value of new contracts or subscriptions that you’ve signed with your customers. Many companies think of bookings simply as “new sales” as it is often what sales teams measure to determine if they have hit their weekly, monthly, quarterly, and/or annual sales targets.

Bookings normally only include new sales to a customer therefore, they exclude subscription renewals but do include expansions or upsells to an existing customer. SaaS companies normally measure bookings in terms of annual or monthly recurring revenue (ie. ARR or MRR).

A booking is normally only recorded when a contractual commitment for a sale exists. The timing of when a commitment exists will differ from company to company. Generally speaking, most startups will normally consider a commitment to exist when a contract, or other legally binding agreement, with the customer has been executed.

Why are Bookings Important?

Bookings are a strong indicator of customer traction and future growth potential. They are also a telltale sign of product-market fit and potential market demand. Bookings further serve as a lead indicator of future revenue as bookings are expected to translate to revenue in the future. As a company scales, bookings are used to measure sales performance and tweak the go-to-market strategy. Many investors will closely evaluate a company’s bookings (assuming the company has begun to make sales) when making an investment.

Financial Statement Impact

Bookings will not appear on your balance sheet or income statement, however it is a common metric that is monitored. Bookings will normally be a part of the key performance indicators (“KPI’s”) tracked by a Company.

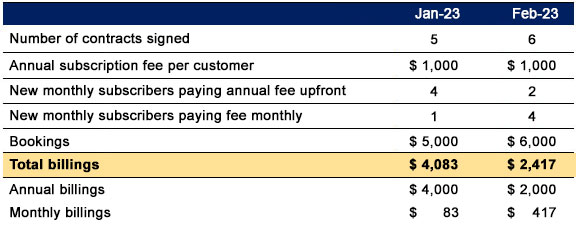

Example

In our example transaction, the bookings will be $5,000 in January 2023 (5 new contracts * $1,000 annual subscription fee) and $6,000 in February 2023 (6 new contracts * $1,000 annual subscription fee). The value of bookings each month will remain the same regardless of whether the annual subscription will be paid upfront or monthly.

What Are Billings?

Billings are the amounts you invoice your customers. This will eventually directly translate to cash receipts.

Why are Billings Important?

Billings are important to manage as it directly impacts your cash balance, and hence, cash life. One of the reasons that SaaS companies often provide customers with a discount to pay annual subscriptions upfront is that it enables the company to extend cash life without outside capital by collecting more from their customers sooner.

Financial Statement Impact

Billings affect your balance sheet as they are recorded as accounts receivable and will eventually become cash when the receivable balance has been collected.

Example

In our sample transaction, the billings in January are greater than the billings in February, even though the bookings in February are greater than the bookings in January. This is due to the fact that more customers opted for the monthly billing option from the February new customer cohort than the January new customer cohort.

What is Revenue?

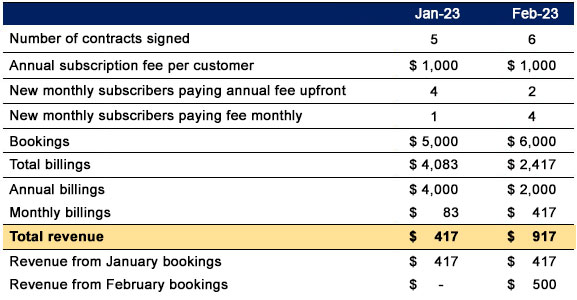

Revenue is income that you earn when you provide your products or services to customers. Unlike bookings and billings, revenue is not recorded until you provide a service/product to your customer. Revenue from subscriptions is normally recognized over the term of the subscription. This can be done on a straight-line basis or using other methods that reflect the pattern of service delivery. For example, if a straight-line basis is used and a customer signs up for a one-year subscription, the revenue is recognized evenly each month over the one-year period (in other words over the term that the service is provided).

Why is Revenue Important?

Revenue provides a way to measure a company’s success. In SaaS subscription models, recurring revenue (ARR/MRR) is a key indicator of stability and growth in your customer base. A Company’s revenue number will normally be a significant component of their valuation, especially in early-stage companies that are scaling.

Financial Statement Impact

Revenue is a key accounting metric that appears on your income statement and will normally be the primary driver of profitability for a SaaS company.

Example

Since all bookings are for an annual subscription, the Company will recognize 1/12 of the total monthly booking as revenue. As mentioned earlier, for the purpose of simplicity, we are not considering pro-rated billings and discounts.

Summary

In summary, bookings, billings, and revenue are distinct financial metrics that provide valuable insights into the financial health, growth and stability of a company. By analyzing these metrics separately, startups can gain a comprehensive understanding of their business performance and make informed decisions for growth. Companies should get ahead of tracking these metrics before investors ask for them as it’ll make the raise process easier.

Startups often struggle to track all three metrics as they don’t have the systems or resources internally to gather the required information. If your startup needs help tracking and analyzing bookings, billings, revenue, or other KPI’s, contact BrightIron and we’d be happy to work with you to get you on the right track.